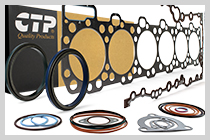

Search and buy New Replacement Caterpillar® Parts and Replacement Komatsu® Parts, equipment and engines. You can search by category, part number or serial number to find the parts you need. You can request a quote online. Our sales team is attentive to help you.

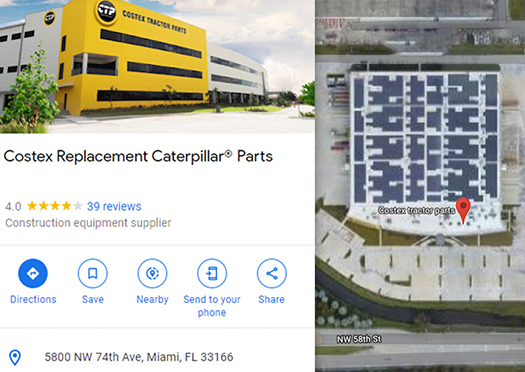

Miami Headquarters:

5800 N.W. 74th Ave

Miami, Florida 33166

Tel: (305) 592-9769

Toll Free in USA: 1 800 321-2451

Subscribe to our Insidetrack Mailing List

NEWS & EVENTS

Intermat Tradeshow – 2024

CTP will be attending Intermat 2024, the Sustainable Construction Solutions & Technology Exhibition. It is the essential must-attend event for all construction industry professionals. Mark your calendar and come visit us at our booth # J034 to see our line of products, discover the latest trends and technological innovations of the construction industry and find out more about the techniques used in the international building sectors.

Miami Location:

© 2024 Costex Tractor Parts. All Rights Reserved. Terms of use & privacy | Sitemap

CTP® and Freddy the Filter® are registered trademarks of Costex Corporation. Cat® and Caterpillar® are registered trademarks of Caterpillar, Inc. Komatsu® is a registered trademark of Komatsu Ltd.

Visit CTP Boxes for your Custom Boxes.